The Best Performing Residential Investment Properties in Albury Wodonga for 2025: What to Buy and Where to Look

The Best Performing Residential Investment Properties in Albury Wodonga for 2025: What to Buy and Where to Look

Key Highlights:

- Albury-Wodonga Real Estate Market Overview: The real estate market in the Albury-Wodonga region has demonstrated robust growth in recent years, attracting considerable interest from both investors and owner-occupiers.

- Top Investment Areas for 2025: According to the latest data, suburbs such as Springvale Heights and West Albury stand out for their impressive performance in both property prices and rental yields, making them prime investment hotspots to watch in 2025.

- Property Price Trends and Rental Yields: These areas have seen double-digit growth in property prices over the past year, with low vacancy rates and high rental yields, indicating strong investment potential.

- Future Development Trends: With ongoing population growth and infrastructure development, the real estate market in Albury-Wodonga is expected to maintain its upward trajectory, offering investors the potential for long-term, stable returns.

Albury-Wodonga Region Overview

Albury-Wodonga is a significant urban cluster located in southeastern Australia, straddling the border between Victoria and New South Wales. It consists of two cities, Albury and Wodonga, situated along the Murray River. As a regional hub, Albury-Wodonga has drawn a considerable number of residents and investors from major cities due to its unique geographic location, steady economic growth, and relatively low cost of living.

Population and Economic Overview:

The total population of Albury-Wodonga is approximately 100,000 (latest data from: Australian Bureau of Statistics), with expectations for continued growth by 2025. The local economy is primarily driven by sectors such as retail, education, healthcare, and manufacturing, with recent benefits from infrastructure development. Notably, the Albury-Wodonga Economic Park has significantly boosted commercial activity and investment opportunities in the region. As the population increases and employment opportunities expand, the real estate market in Albury-Wodonga is steadily warming.

Infrastructure and Transport:

The region’s infrastructure continues to improve, offering convenient transportation. Albury serves as a major rail hub, while Wodonga is connected to Melbourne and Sydney via highways. New transportation projects, such as the expansion plan for Albury Airport, are expected to further stimulate the area’s economic growth, particularly within the real estate market. Additionally, housing developments and commercial facilities scheduled for completion in 2025 will have a profound impact on the market.

| Indicator | 2023 Data | 2025 Projected Data |

|---|---|---|

| Total Population | 100,000 | 105,000 |

| Median House Price | 490,000 AUD | 520,000 AUD |

| Average Rental Income | 1,100 AUD/month | 1,150 AUD/month |

Data Sources:

– Australian Bureau of Statistics

– Albury City Council

Analysis of the Best Investment Areas for 2025

According to the latest market data, Springvale Heights and West Albury in the Albury-Wodonga region exhibit strong investment potential for 2025. Below is a detailed analysis of these two areas:

Springvale Heights

- Property Price Trends: As of October 2024, the median house price in Springvale Heights stands at $550,000, reflecting an 8% increase compared to the same period in 2023.

- Rental Yield: The average rental yield in this area is 4.5%, surpassing the average yield for the Albury-Wodonga region.

- Vacancy Rate: Springvale Heights has a vacancy rate of 1.2%, indicating a strong demand for rental properties.

Table 1: Springvale Heights Market Data

| Metric | Value |

|---|---|

| Median House Price | $550,000 |

| Price Increase (YoY) | 8% |

| Rental Yield | 4.5% |

| Vacancy Rate | 1.2% |

West Albury

- Property Price Trends: As of October 2024, the median house price in West Albury is $600,000, showing a 7% increase from the same period in 2023.

- Rental Yield: The average rental yield in this area is 4.2%, also higher than the regional average.

- Vacancy Rate: West Albury’s vacancy rate stands at 1.5%, further reflecting a robust rental market.

Table 2: West Albury Market Data

| Metric | Value |

|---|---|

| Median House Price | $600,000 |

| Price Increase (YoY) | 7% |

| Rental Yield | 4.2% |

| Vacancy Rate | 1.5% |

Data Sources:

– Albury Wodonga Real Estate Market Report

Other Investment Areas to Watch

In addition to Springvale Heights and West Albury, the Albury-Wodonga region has several other areas that have shown strong performance in real estate investment. Below is an analysis of North Albury, Lavington, Wodonga, and Thurgoona:

North Albury

- Property Price Trends: As of October 2024, the median house price in North Albury is $480,000, reflecting a 6% increase compared to the same period in 2023.

- Rental Yield: The average rental yield in this area is 4.0%, which is higher than the regional average.

- Vacancy Rate: North Albury has a vacancy rate of 1.0%, indicating a strong demand for rental properties.

Table 1: North Albury Market Data

| Metric | Value |

|---|---|

| Median House Price | $480,000 |

| Price Increase (YoY) | 6% |

| Rental Yield | 4.0% |

| Vacancy Rate | 1.0% |

Lavington

- Property Price Trends: As of October 2024, the median house price in Lavington is $500,000, marking a 5% increase from the same period in 2023.

- Rental Yield: The average rental yield in this area is 4.3%, exceeding the regional average.

- Vacancy Rate: Lavington has a vacancy rate of 1.1%, further reflecting a vibrant rental market.

Table 2: Lavington Market Data

| Metric | Value |

|---|---|

| Median House Price | $500,000 |

| Price Increase (YoY) | 5% |

| Rental Yield | 4.3% |

| Vacancy Rate | 1.1% |

Wodonga

- Property Price Trends: As of October 2024, the median house price in Wodonga stands at $550,000, a 7% increase from the same period in 2023.

- Rental Yield: The average rental yield in Wodonga is 4.2%, higher than the regional average.

- Vacancy Rate: Wodonga has a vacancy rate of 1.2%, suggesting strong rental demand.

Table 3: Wodonga Market Data

| Metric | Value |

|---|---|

| Median House Price | $550,000 |

| Price Increase (YoY) | 7% |

| Rental Yield | 4.2% |

| Vacancy Rate | 1.2% |

Thurgoona

- Property Price Trends: As of October 2024, the median house price in Thurgoona is $530,000, reflecting a 6% increase compared to the same period in 2023.

- Rental Yield: The average rental yield in this area is 4.1%, above the regional average.

- Vacancy Rate: Thurgoona has a vacancy rate of 1.0%, indicating strong rental demand.

Table 4: Thurgoona Market Data

| Metric | Value |

|---|---|

| Median House Price | $530,000 |

| Price Increase (YoY) | 6% |

| Rental Yield | 4.1% |

| Vacancy Rate | 1.0% |

Data Sources:

– Albury Wodonga Real Estate Market Report

Market Trends and Future Outlook

The real estate market in the Albury-Wodonga region has experienced sustained growth over the past few years, driven primarily by the following factors:

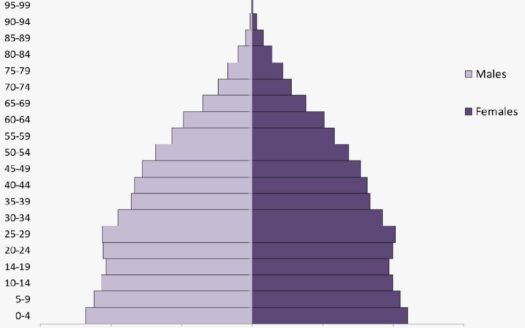

Population Growth

According to statistics from Albury City, between June 2022 and June 2023, the population of Albury grew by 1.5%, reaching 57,517 residents, an increase of 852 people. Similarly, Wodonga saw a 1.3% growth, bringing its population to 44,276. This brings the total population of the Albury-Wodonga region to 101,793. As the population continues to grow, real estate demand is expected to rise further, driving market development.

Table 1: Population Growth in Albury-Wodonga (June 2022 – June 2023)

| Area | Population (June 2023) | Population Growth (YoY) |

|---|---|---|

| Albury | 57,517 | 1.5% |

| Wodonga | 44,276 | 1.3% |

| Total | 101,793 | N/A |

Infrastructure Development

Several infrastructure projects are underway in the Albury-Wodonga region to support future growth. The Albury Wodonga Regional Hospital project will provide state-of-the-art healthcare facilities to meet the growing demand for medical services. Additionally, the Hydrogen Park Murray Valley project is under construction and is expected to begin operations in 2025, providing renewable hydrogen and supporting the region’s energy transition. These projects will enhance the region’s appeal, further boosting the real estate market.

Table 2: Key Infrastructure Projects in Albury-Wodonga

| Project | Description | Expected Completion Date |

|---|---|---|

| Albury Wodonga Regional Hospital | A state-of-the-art healthcare facility to meet growing medical demand. | N/A |

| Hydrogen Park Murray Valley Project | Construction of a renewable hydrogen plant to support energy transition. | 2025 |

Policy Support

In 2022, both AlburyCity and Wodonga Council updated their “Two Cities, One Community” strategic plan, emphasizing collaboration and development to support regional growth. Additionally, the Albury Wodonga Regional Deal has been included as a priority initiative, aimed at promoting tourism, transportation, and regional expansion. These policy measures will create a favorable environment for the real estate market, attracting more investors and homebuyers.

Data Sources:

– AlburyCity Population Statistics

– Albury Wodonga Regional Hospital Project

– Hydrogen Park Murray Valley Project

– Two Cities, One Community Strategic Plan

– Albury Wodonga Regional Deal

Investment Recommendations and Considerations

When considering real estate investment in the Albury-Wodonga region, the following recommendations and considerations are worth noting:

Investment Strategies

- Diversified Portfolio: It is recommended that investors spread their investments across multiple areas such as Springvale Heights, West Albury, North Albury, Lavington, Wodonga, and Thurgoona. This strategy will help mitigate risk and capture the growth potential across different regions.

- Focus on Emerging Areas: Areas such as North Albury and Thurgoona are experiencing rapid property price growth, high rental yields, and low vacancy rates, showcasing strong investment potential.

Table 1: Key Investment Metrics by Area

| Area | Median House Price | Price Increase (YoY) | Rental Yield | Vacancy Rate |

|---|---|---|---|---|

| Springvale Heights | $550,000 | 8% | 4.5% | 1.2% |

| West Albury | $600,000 | 7% | 4.2% | 1.5% |

| North Albury | $480,000 | 6% | 4.0% | 1.0% |

| Lavington | $500,000 | 5% | 4.3% | 1.1% |

| Wodonga | $550,000 | 7% | 4.2% | 1.2% |

| Thurgoona | $530,000 | 6% | 4.1% | 1.0% |

Risk Assessment

- Market Fluctuations: While the Albury-Wodonga real estate market has shown strong performance, investors should be cautious of potential market fluctuations, especially in times of economic uncertainty.

- Policy Changes: Changes in government policies, such as adjustments to land tax, stamp duty, or other tax regulations, may affect the real estate market. Investors should stay informed about these policy developments.

Resources and Support

- Professional Advice: It is advisable for investors to consult local real estate agents and financial advisors for expert market analysis and investment guidance.

- Government Support: AlburyCity and Wodonga Council offer various support measures, including first-time homebuyer grants and incentives for investors. Investors should familiarize themselves with these resources and take advantage of them.

Data Sources:

– Albury Wodonga Real Estate Market Report

– AlburyCity Population Statistics

– Albury Wodonga Regional Hospital Project

– Hydrogen Park Murray Valley Project

– Two Cities, One Community Strategic Plan

– Albury Wodonga Regional Deal

– McGrath Albury/Wodonga Real Estate Agency